Renters Insurance in and around Inglewood

Inglewood renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Inglewood

- Los Angeles

- Arizona

- Phoenix

- Scottsdale

- Tucson

- San Diego

- San Francisco

- Long Beach

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or house, renters insurance can be one of those most reasonable things you can do to protect your valuables, including your furniture, silverware, books, tools, and more.

Inglewood renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

There's No Place Like Home

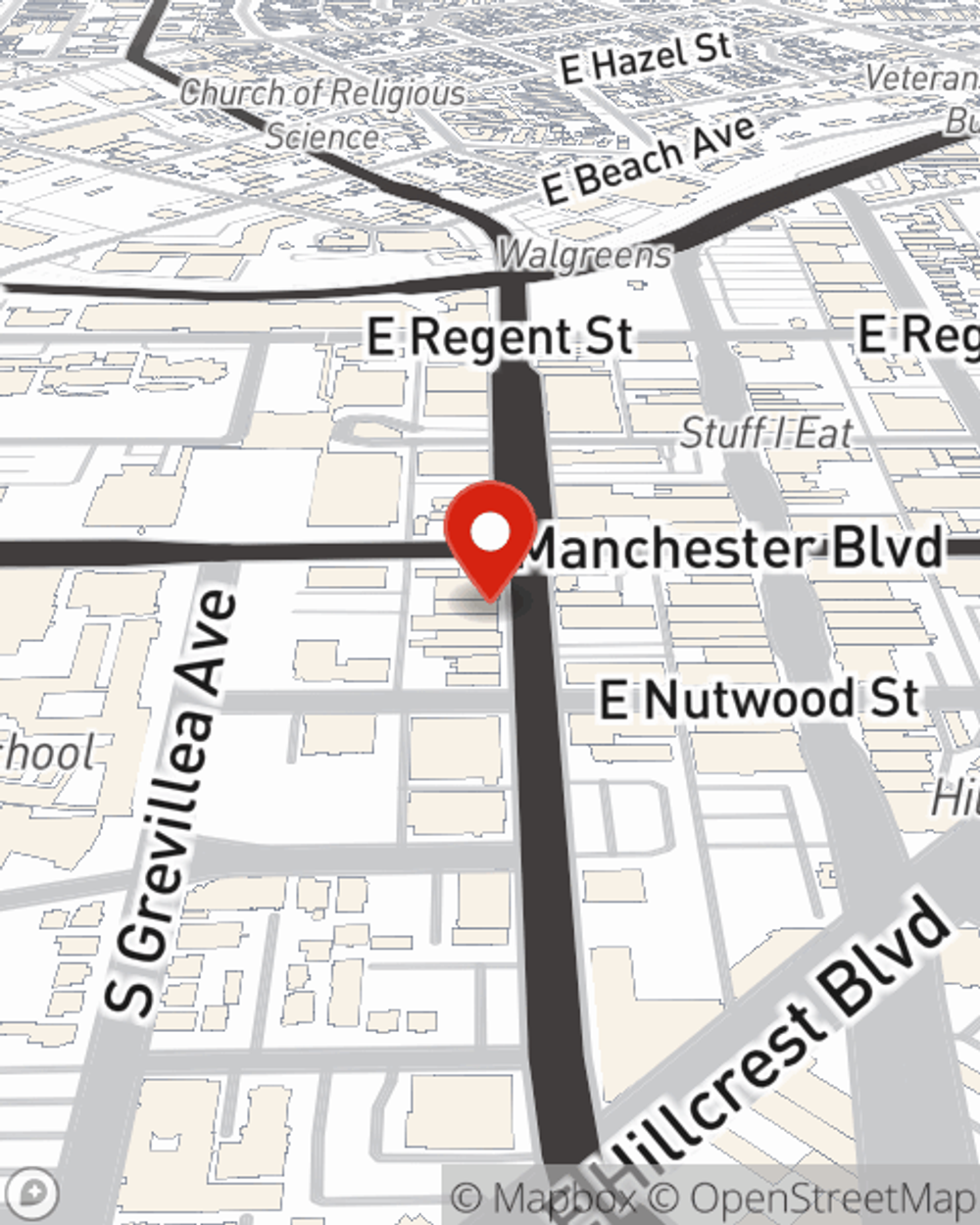

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Florence Harrison can help you identify the right coverage for when the unexpected, like a water leak or a fire, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Inglewood renters, are you ready to talk about the advantages of choosing State Farm? Visit State Farm Agent Florence Harrison today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Florence at (310) 330-8220 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Florence Harrison

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.